The Surprising Secrets of America's Wealthy

by Thomas J. Stanley and William D. Danko.

This book is a compilation of research done by the two authors in the profiles of 'millionaires'. In this case they used the term 'millionaire' to denote U.S. households with net-worth’s exceeding one million dollars (USD).

UAWs Versus PAWs

The authors suggest that an "Average Accumulator of Wealth (AAW)" should have a net worth equal to one-tenth their age multiplied by their current annual income from all sources. E.g., a 50-year-old person who over the past twelve months earned employment income of $45,000 and investment income of $5,000 should have an expected net worth of $250,000. An "Under Accumulator of Wealth (UAW)" would have half that amount, and a "Prodigious Accumulator of Wealth (PAW)" would have two times..

Most of the millionaire households that they profiled did not have the extravagant lifestyles that most people would assume. This finding is backed up by surveys indicating how little these millionaire households have spent on such things as cars, watches, suits, and other luxury products/services. Most importantly, the book gives a list of reasons for why these people managed to accumulate so much wealth (the top one being that "They live below their means"). The authors make a distinction between the 'Balance Sheet Affluent' (those with actual wealth, or high net-worth) and the 'Income Affluent' (those with a high income, but little actual wealth, or low net-worth).

Main Points

Spend Less Than You Earn

If you are always spending up to or above what you earn, you will never increase your net worth no matter how much you make. The author discusses being frugal: prudent and frugal.

Avoid Buying Status Objects or Leading a Status Lifestyle

Buying expensive imported vehicles is poor value and you will constantly need to buy the newest model. Buying status objects such as branded consumer goods is a never-ending cycle of depreciating assets. Living in a status neighborhood is not only poor value, but you will feel the need to keep buying status objects to keep up with your neighbours, who are mostly UAWs.

PAWs Are Willing to Take Financial Risk if it is Worth the Reward

PAWs are not misers who put every penny under their mattress. They invest their money for good returns, and will consider riskier investments if they're worth the reward. Many put money not in the stock market, but invest in private businesses and venture capital. They do not gamble or speculate on long-odds stocks.

Economic Outpatient Care

The authors also make the interesting observation that UAWs tend to have children who require an influx of their parents' money in order to afford the lifestyle that they expect for themselves, and that they are less likely to have been taught about money, budgeting and investing by their parents.

skip to main |

skip to sidebar

“To Thine Own Self Be True”

Coaching - ASIA

Gone But Never Forgotten and Forever Missed

Leo Buscaglia

A Complaint Free World

A Must Read

A Must Read

Whispering in the Wind

A Must Read

A Very Must Read

A Very Must Read

A Must Read

A Must Read

Change Your Life

A Must Read

The Tipping Pint

Blink

Outliers

Esther & Jerry Hicks

One More Day

Tuesdays witha Tuesdays with Moray

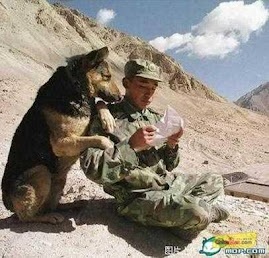

A Very Inspiring, A Noble Young Man and One COOL Dude!

We Could Learn A Lot

My Roots

Sadly Missed

Long Time Ago

The Foundation of Everything

Cool!

Fundamental Foundations for Success in Life

“To Thine Own Self Be True”

RIP Madiba

Contact Details ...

Coaching & Training Programmes

CSE - Client Service Engineering

2 Day Workshop on Service - 10 Steps

RTM - Rail Track Mindset

13 Week Activity Programme for Sales

One on One - Personal Coaching

Building Your Foundations for Success

2 Day Workshop on Service - 10 Steps

RTM - Rail Track Mindset

13 Week Activity Programme for Sales

One on One - Personal Coaching

Building Your Foundations for Success

Training Partners

Coaching - ASIA

I Am ...

I Am As My Father Created Me To Be I Am Free Nothing Whatsoever Can Influence Me Unless I Allow I Need Do Nothing

Life!

Your life is not a random series of events.

There are no accidents. Everything has been planned with pinpoint accuracy.

There are no accidents. Everything has been planned with pinpoint accuracy.

Live

“Dream as if you'll live forever. Live as if you'll die today.”

James Dean

1931-1955

James Dean

1931-1955

The Way ...

Change

Teachers

"My goal is to translate response into results. Some teachers teach for others to learn. That's not me. Some teachers teach for others to accomplish. That is me."

Jim Rohn

Jim Rohn

Albert Einstein

"Learn from yesterday, live for today, hope for tomorrow.

The important thing is to not stop questioning."

The important thing is to not stop questioning."

4 Questions

For True Success Ask Yourself These Four Questions:

1. Why?

2. Why Not?

3. Why Not Me?

4. Why Not Now?"

James Allen

1. Why?

2. Why Not?

3. Why Not Me?

4. Why Not Now?"

James Allen

Quiet

Only In Quiet Waters Things Mirror Themselves Undistorted. Only In A Quiet Mind Is Adequate Perception Of The World.

Hans Margolius

Hans Margolius

Life Paper

Complaint Free World

Impact On Your World

“What you are creates an impact on your world. In the past, your impact may have been negative because of your propensity to complain. Now, however, you are modeling optimism and a better world for all. You are a ripple in the great ocean of humanity that resounds around the world.”

Will Bowen

Will Bowen

Maya Angelou

If you don‟t like something, change it;

If you can‟t change it, change your attitude.

Don‟t complain.

If you can‟t change it, change your attitude.

Don‟t complain.

Life

"Life is not measured by the number of breaths we take, but by the moments that take our breath away."

Maya Angelou

Maya Angelou

5 Minutes Complaining

"If you spend five minutes complaining, you have just wasted five minutes. If you continue complaining, it won't be long before they haul you out to a financial desert and there let you choke on the dust of your own regret."

Jim Rohn

Jim Rohn

Gift by Jim Rohn

"The greatest gift you can give to somebody is your own personal development.

I used to say, 'If you will take care of me, I will take care of you.'

Now I say, 'I will take care of me for you, if you will take care of you for me.'"

I used to say, 'If you will take care of me, I will take care of you.'

Now I say, 'I will take care of me for you, if you will take care of you for me.'"

Jim Rohn

Gone But Never Forgotten and Forever Missed

In Me

"What I am looking for is not out there, it is in me."

Helen Keller

Helen Keller

You

"Everything you see has its roots in the unseen world. The forms may change, yet the essence remains the same. Every wonderful sight will vanish; every sweet word will fade, But do not be disheartened, The source they come from is eternal, growing, Branching out, giving new life and new joy. Why do you weep? The source is within you And this whole world is springing up from it."

Jelaluddin Rumi

Jelaluddin Rumi

Too Often

Leo Buscaglia

Must Visit Web Sites

Hero; For Daddy.

No such scientific tool were invented to prove, our relation. No matching DNA nor blood to claim I was yours. When truth be told, every trait I had, the manner I presented myself and my mentality. Is in fact and in every form, a product of my Daddy. The man whom they whisper, " Her real father . . . ", was nothing more than a man who donated a piece of himself towards my making. Calling him a stranger would be an understatement. He's non-existing. He's nothing. Daddy, you are a hero in the form of a man. I owe you all that I am today.

You will be the only man I would call my father; and without a doubt you proudly wear me as your Daughter. The same little girl you found such a sacrifice to accept her growing up. Thank you for sharing your knowledge. The respect I have for you is mountainous. I love you, Daddy.

Xx.

You will be the only man I would call my father; and without a doubt you proudly wear me as your Daughter. The same little girl you found such a sacrifice to accept her growing up. Thank you for sharing your knowledge. The respect I have for you is mountainous. I love you, Daddy.

Xx.

The Power of Discipline

"No stream or gas drives anything until it is confined.

No Niagara is ever turned into light and power until it is tunneled. No life ever grows great until it is focused, dedicated and disciplined."

Harry E. Fosdick

No Niagara is ever turned into light and power until it is tunneled. No life ever grows great until it is focused, dedicated and disciplined."

Harry E. Fosdick

Focus

Don’t Focus On What You Can’t Do; Focus On What You Can Do.

Thomas Chua

Thomas Chua

Self Awareness

"Sometimes I lie awake at night, and I ask, 'Where have I gone wrong?' Then a voice says to me, 'This is going to take more than one night.'"

Charles M. Schulz

Charles M. Schulz

Me!

Quod Me Netrit Me Destruit

(What nourishes me also destroys me)

(What nourishes me also destroys me)

Truth

Very few of us are authorities on the truth. About the closest that any of us can get is what we hope is the truth or what we think is the truth. That's why the best approach to truth is probably to say, "It seems to me..."

There is nothing wrong with affirmations, provided what you are affirming is the truth. If you are broke, for example, the best thing to affirm is, "I'm broke!"

If the truth isn't enough, then you must become stronger at presenting it.

Sincerity is not a test of truth. We must not make this mistake: He must be right; he's so sincere. Because, it is possible to be sincerely wrong. We can only judge truth by truth and sincerity by sincerity.

Jim Rohn

There is nothing wrong with affirmations, provided what you are affirming is the truth. If you are broke, for example, the best thing to affirm is, "I'm broke!"

If the truth isn't enough, then you must become stronger at presenting it.

Sincerity is not a test of truth. We must not make this mistake: He must be right; he's so sincere. Because, it is possible to be sincerely wrong. We can only judge truth by truth and sincerity by sincerity.

Jim Rohn

Truth

Law of Attraction

Whatever you're thinking about is literally like planning a future event.

When you're worrying, you are planning.

When you're appreciating you are planning...

What are you planning?

Abraham

When you're worrying, you are planning.

When you're appreciating you are planning...

What are you planning?

Abraham

Grateful

"When we choose not to focus on what's missing from our lives but are grateful for the abundance that's present... we experience heaven on earth."

Worry

Do you remember the things you were worrying about a year ago? Didn't you waste a lot of fruitless energy on account of most of them? Didn't most of them turn out all right after all?

Dale Carnegie

Dale Carnegie

Commitment & Consistency

"I believe life is constantly testing us for our level of commitment, and life's greatest rewards are reserved for those who demonstrate a never-ending commitment to act until they achieve.

This level of resolve can move mountains, but it must be constant and consistent. As simplistic as this may sound, it is still the common denominator separating those who live their dreams from those who live in regret."

Anthony Robbins

This level of resolve can move mountains, but it must be constant and consistent. As simplistic as this may sound, it is still the common denominator separating those who live their dreams from those who live in regret."

Anthony Robbins

Invictus by William Ernest Henley

Out of the night that covers me,

Black as the Pit from pole to pole,

I thank whatever gods may be

For my unconquerable soul.

In the fell clutch of circumstance

I have not winced nor cried aloud.

Under the bludgeonings of chance

My head is bloody, but unbowed.

Beyond this place of wrath and tears

Looms but the Horror of the shade,

And yet the menace of the years

Finds, and shall find, me unafraid.

It matters not how strait the gate,

How charged with punishments the scroll.

I am the master of my fate:

I am the captain of my soul.

Black as the Pit from pole to pole,

I thank whatever gods may be

For my unconquerable soul.

In the fell clutch of circumstance

I have not winced nor cried aloud.

Under the bludgeonings of chance

My head is bloody, but unbowed.

Beyond this place of wrath and tears

Looms but the Horror of the shade,

And yet the menace of the years

Finds, and shall find, me unafraid.

It matters not how strait the gate,

How charged with punishments the scroll.

I am the master of my fate:

I am the captain of my soul.

Chiune Sugihara

Do the Right Thing, Because It is The Right Thing

This Quiet Dust by Emily Dickinson

This quiet dust was gentlemen and ladies And lads and girls; Was laughter and ability and sighing, And frocks and curls;

This passive place a summer's nimble mansion, Where bloom and bees fulfilled their oriental circuit, Then ceased like these.

This passive place a summer's nimble mansion, Where bloom and bees fulfilled their oriental circuit, Then ceased like these.

The Secret Sits

We Dance Round In A Ring And Suppose,

But The Secret Sits In The Middle And Knows.

Robert Frost

But The Secret Sits In The Middle And Knows.

Robert Frost

The Right Path

"If You're Walking Down The Right Path And You're Willing To KeepWalking, Eventually You'll Make Progress."

Barack Obama

Barack Obama

Life Force

Let what you're living right here and now in this environment be the process that evokes the desire that summons the Life Force that provides the creation of anything. Whatever you have the ability to conceive, this Universe has the ability to provide. Anything, without exception. So your work is on the conjuring of the idea, period. The Universe has the stuff to deliver the goods, and will.

Abraham

Abraham

Abraham

Life is supposed to be fun. You said, "I'll go forth and choose. I'll look at the data, and I'll say, yes to this, and yes to this, and yes to this, and I'll paint a picture of the things that I want, and I'll vibrate about them, because that's what I'm giving my attention to. And the Universe will respond to my vibration. And then I'll stand in a new place where a whole new batch of yeses are available, and I'll say yes to this, and yes to this, and yes to this." You did not say, "I'll go forth and struggle into joy", because from your Nonphysical Perspective you know it is vibrationally not possible. You cannot struggle to joy. Struggle and joy are not on the same channel. You joy your way to joy. You laugh your way to success. It is through your joy that good things come.

Mistakes

Cant but Can!

You Can't Decide The Length Of our Life,

But You Can Control How You Want To Live It.

You Can’t Control The Weather,

But You Can Control Your Mood.

You Can't Change Your Look,

But You Can Smile.

You Can’t Control Others,

But You Can Control Yourself.

You Can't Foresee Tomorrow,

But You Can Utilize Today Wisely.

You Can't Win Everything,

But You Can Try Your Very Best To Achieve That.

But You Can Control How You Want To Live It.

You Can’t Control The Weather,

But You Can Control Your Mood.

You Can't Change Your Look,

But You Can Smile.

You Can’t Control Others,

But You Can Control Yourself.

You Can't Foresee Tomorrow,

But You Can Utilize Today Wisely.

You Can't Win Everything,

But You Can Try Your Very Best To Achieve That.

The Final Analysis

People Are Often Unreasonable, Illogical and Self Centered, Forgive Them Anyway.

If You Are Kind, People May Accuse You of Selfish Ulterior Motives, Be Kind Anyway.

If You Are Successful You Will Win Some False Friends and Some True Enemies, Succeed Anyway. If You Are Honest and Frank, People May Cheat You,

Be Honest and Frank Anyway What You Spend Years Building, Someone May Destroy Overnight, Build Anyway. If You Find Serenity and Happiness, They May Be Jealous,

Be Happy Anyway. The Good You Do Today, People Will Often Forget Tomorrow, Do Good Anyway. Give the World the Best You Have and It May Just Never Be Enough,

Give the World the Best You Have Anyway. You See, In the Final Analysis, Its All between You and God;

It Was Never Between You And Them Anyway.

Mother Theresa

If You Are Kind, People May Accuse You of Selfish Ulterior Motives, Be Kind Anyway.

If You Are Successful You Will Win Some False Friends and Some True Enemies, Succeed Anyway. If You Are Honest and Frank, People May Cheat You,

Be Honest and Frank Anyway What You Spend Years Building, Someone May Destroy Overnight, Build Anyway. If You Find Serenity and Happiness, They May Be Jealous,

Be Happy Anyway. The Good You Do Today, People Will Often Forget Tomorrow, Do Good Anyway. Give the World the Best You Have and It May Just Never Be Enough,

Give the World the Best You Have Anyway. You See, In the Final Analysis, Its All between You and God;

It Was Never Between You And Them Anyway.

Mother Theresa

Take A Chance

Take A Chance! All Life Is A Chance. The Person Who Goes Farthest Is Generally The One Who Is Willing To Do And Dare. The 'Sure Thing' Boat Never Gets Far From Shore.

Dale Carnegie

Dale Carnegie

The Beauty Of The Soul

The Beauty Of The Soul Shines Out When A Man Bears With Composure One Heavy Mischance After Another, Not Because He Does Not Feel Them, But Because He Is A Man Of High And Heroic Temper

Aristotle

Aristotle

By Chance

By Chance, You Will Say, But Chance Only Favors The Mind Which Is Prepared.

Louis Pasteur

Louis Pasteur

I Had To Succeed

I Had To Succeed Because I had Run Out Of Things That Wouldn’t Work.

Thomas Edison

Thomas Edison

No Man Is An Island

No Man Is An Island, Entire Of Itself; Every Man Is A Piece Of The Continent, A Part Of The Main; If A Clod Be Washed Away By The Sea, Europe Is The Less, As Well As If A Promontory Were, As Well As If A Manor Of Thy Friends Or Thine Own Were; Any Mans Death Diminishes Me, Because I Am Involved In Mankind; And Therefore Never Send To Know For Whom The Bell Tolls; It Tolls For Thee.

John Donne

Read In Your Face

Did You Realize That It Is Possible To Read In Your Face And Manner The Record Of Your Thoughts; That Your Face Is A Bulletin Board Upon Which Is Advertised What Has Been Going On In Your Mind For Years?

Orison Swett Marden

Orison Swett Marden

The Physical Expression On Our Face

But The Physical Expression On Our Face Isn't The Only Reflection Of Our Inner State. The Condition Of Our Finances, Our Health And Our Relationships Are Also A Reflection Of What's Going On Inside. One Of The Greatest "Awakenings" That I Experienced Was When I Realized That My Habitual Thinking Had Created My Outer Conditions. Up Until That Time I Thought It Was The Other Way Around. I Thought The Reason I Was Depressed Was Because Of What Was Happening To Me. With That Kind Of Thinking It's Easy To Understand Why I Wasn't In Control Of My Life

Orison Swett Marden

Orison Swett Marden

Benjamin Franklin

If A Man Empties His Purse Into His Head, No Man Can Take It Away From Him. An Investment In Knowledge Always Pays The Best Interest.

Benjamin Franklin

Benjamin Franklin

Abraham Lincoln

Most Folks Are About As Happy As They Make Up Their Minds To Be.

Abraham Lincoln

Abraham Lincoln

Every Now And Then Go Away

Every Now And Then Go Away, Have A Little Relaxation, For When You Come Back To Your Work Your Judgment Will Be Surer; Since To Remain Constantly At Work Will Cause You To Lose Power Of Judgment. Go Some Distance Away Because The Work Appears Smaller And More Of It Can Be Taken In At A Glance, And A Lack Of Harmony Or Proportion Is More Readily Seen.

Leonardo Da Vinci

Leonardo Da Vinci

For A Dancer

Just Do The Steps That You’ve Been Shown, By Everyone You’ve Ever Known, Until The Dance Becomes Your Own, Into A Dancer You Have Grown From The Seed Someone Else Has Thrown, Go On Ahead And Throw Some Seeds Of Your Own Somewhere Between The Time You Arrive And The Time You Go Home Because In The End There Is One Dance You’ll Do Alone.

Jackson Brown

Jackson Brown

Neither A Borrower Nor A Lender Be

Neither A Borrower Nor A Lender Be; For Loan Oft Loses Both Itself And Friend, And Borrowing Dulls The Edge Of Husbandry. This Above All: To Thine Ownself Be True, And It Must Follow, As The Night The Day, Thou Canst Not Then Be False To Any Man

William Shakespeare

William Shakespeare

There Is A Tide In The Affairs Of Men

There Is A Tide In The Affairs Of Men,Which Taken At The Flood, Leads On To Fortune; Omitted, All The Voyage Of Their Life Is Bound In Shallows And In Miseries. On Such A Full Sea Are We Now Afloat, And We Must Take The Current When It Serves, Or Lose Our Ventures.

Julius Caesar

Julius Caesar

Men Are Disturbed

Men Are Disturbed Not By Things That Happen.

But By Their Opinions Of The Things That Happen

Epictetus

But By Their Opinions Of The Things That Happen

Epictetus

The Moving Finger Writes

The Moving Finger Writes; And Having Writ, Moves On: Nor All The Piety Nor Wit Shall Lure It Back To Cancel Half A Line, Nor All Thy Tears Wash Out A Word Of It.

Omar Khayyam

Omar Khayyam

I Saw Grief Drinking A Cup Of Sorrow

I Saw Grief Drinking A Cup Of Sorrow And I Called. It Tastes Sweet, Does It Not? You’ve Caught Me Grief Answered And You’ve Ruined My Business, How Can I Sell Sorrow When You Know It’s A Blessing

Jalaluddin Rumi

Jalaluddin Rumi

The Six Mistakes of Man

1. The illusion that personal gain is made up of crushing others

2. The tendency to worry about things that cannot be changed or corrected

3. Insisting that a thing is impossible because cannot accomplish it

4. Refusing to set aside trivial preferences

5. Neglecting development and refinement of the mind, and not acquiring the habit of reading and study

6. Attempting to compel others to believe and live as we do

Marcus Tullius Cicero

2. The tendency to worry about things that cannot be changed or corrected

3. Insisting that a thing is impossible because cannot accomplish it

4. Refusing to set aside trivial preferences

5. Neglecting development and refinement of the mind, and not acquiring the habit of reading and study

6. Attempting to compel others to believe and live as we do

Marcus Tullius Cicero

The Greater Danger For Most Of Us

The Greater Danger For Most Of Us Is Not That Our Aim Is Too High And We Miss It, But That It Is Too Low And We Reach It

Michelangelo Buonarroti

Michelangelo Buonarroti

All Mans Miseries

All Mans Miseries Derive From Not Being Able To Sit Quietly In A Room Alone

Blaise Pascal

Blaise Pascal

Lose This Day

Lose This Day Loitering – T’will Be The Same Story To-morrow – And The Next More Dilatory; Each Indecision Brings Its Own Delays, And Days Are Lost Lamenting O’er Lost Days. Are You In Earnest? Seize This Very Minute – Boldness Has Genius In It. Only Engage, And Then The Mind Grows Heated – Begin It, And Then The Work Will Be Completed

Johann Wolfgang von Goethe

Johann Wolfgang von Goethe

Inspired

When You Are Inspired By Some Great Purpose, Some Extraordinary Project, All Your Thoughts Break Their Bonds; Your Mind Transcends Limitations, Your Consciousness Expands In Every Direction, And You Find Yourself In A New, Great And Wonderful World. Dormant Forces, Faculties And Talents Become Alive, And You Discover Yourself To Be A Greater Person By Far Than You Ever Dreamed Yourself To Be

Patanjali

Patanjali

Deepest Fear

Our Deepest Fear Is Not That We Are Inadequate. Our Deepest Fear Is That We Are Powerful Beyond Measure. It Is Our Light, Not Our Darkness, That Most Frightens Us. We Ask Ourselves, "Who Am I To Be Brilliant?“ Actually, Who Are You Not To Be? You Are A Child Of God. Your Playing Small Doesn't Serve The World. There's Nothing Enlightened About Shrinking So That Other People Won't Feel Insecure Around You. We Are Born To Make Manifest The Glory Of God That Is Within Us. It Is Not Just In Some Of Us; It's In Everyone. And As We Let Our Light Shine, We Unconsciously Give Other People Permission To Do The Same. As We Are Liberated From Our Own Fear, Our Presence Automatically Liberates Others

Marian Williamson

Marian Williamson

Tahiti

For As This Appalling Ocean Surrounds The Verdant Land, So In The Soul Of Man There Lies One Insular Tahiti, Full Of Peace And Joy, But Encompassed By All The Horrors Of The Half Known Life.

Herman Melville

Herman Melville

Pigs

Never Try To Teach a Pig To Sing, It Wastes Your Time and Annoys the Pig.

Mark Twain

Mark Twain

Do Not Believe

Do Not Believe In What You Have Heard

Do Not Believe In Tradition Because It Is Handed Down By Many Generations

Do Not Believe In Anything That Has Been Spoken Of Many TimesDo Not Believe Because The Written Statements Come From Some Old Sage

Do Not Believe In Conjecture

Do Not Believe In Authority Or Teachers Or EldersBut After Careful Observation And Analysis, When It Agrees With Reason And It Will Benefit One And All, Then Accept It And Live By It.

Buddha

Do Not Believe In Tradition Because It Is Handed Down By Many Generations

Do Not Believe In Anything That Has Been Spoken Of Many TimesDo Not Believe Because The Written Statements Come From Some Old Sage

Do Not Believe In Conjecture

Do Not Believe In Authority Or Teachers Or EldersBut After Careful Observation And Analysis, When It Agrees With Reason And It Will Benefit One And All, Then Accept It And Live By It.

Buddha

Will Bowen

A Complaint Free World

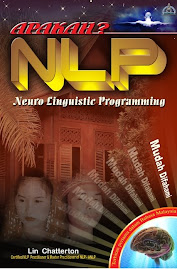

Apakah NLP

A Must Read

Dr Richard Bandler

A Must Read

Dr John Grinder

Whispering in the Wind

Eckhart Tolle

A Must Read

Think and Grow Rich

A Very Must Read

How To Win Friends

A Very Must Read

The Richest Man

A Must Read

7 Habits

A Must Read

Dr Wayne Dyer

Change Your Life

The Millionaire Next Door

A Must Read

Malcolm Gladwell

The Tipping Pint

Malcolm Gladwell

Blink

Malcolm Gladwell

Outliers

Ask and it is Given

Esther & Jerry Hicks

Mitch Albom

One More Day

Mitch Albom

Tuesdays witha Tuesdays with Moray

Thomas Chua & DPG Singapore

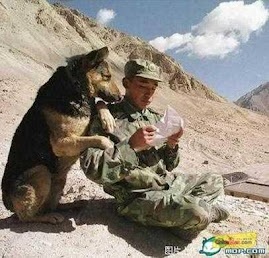

A Very Inspiring, A Noble Young Man and One COOL Dude!

True Friendship

We Could Learn A Lot

My Roots

My Roots

Past Life

The Boys

Sadly Missed

Liberty Life (Alex & Me)

Long Time Ago

Ownself Be True

The Foundation of Everything

Very Smart Dog

Cool!

High Noon

If You're Honest You're Poor Your Whole Life And In The End You Wind Up Dying All Alone On Some Dirty Street

About Me

Rat (Thats me)

Stupidity

No BullShit

Cool Epitaph.

The Hour Of Departure Has Arrived,

And We Go Our Ways.

I To Die And You To Live.

Which Is The Better, Only God Knows.

Socrates.

And We Go Our Ways.

I To Die And You To Live.

Which Is The Better, Only God Knows.

Socrates.